The Art of the LOI: Setting the Stage for Deal Success

Presented By: CIBC / Louis Plung & Company

A well-crafted Letter of Intent (LOI) can be the difference between a seamless transaction and a deal that derails. In this insightful panel, deal veterans share why LOIs are critical in defining terms, aligning expectations, and smoothing negotiations before due diligence begins. From identifying essential provisions to navigating potential pitfalls, this discussion will reveal how to structure LOIs that build trust, reduce risks, and pave the way for successful closings.

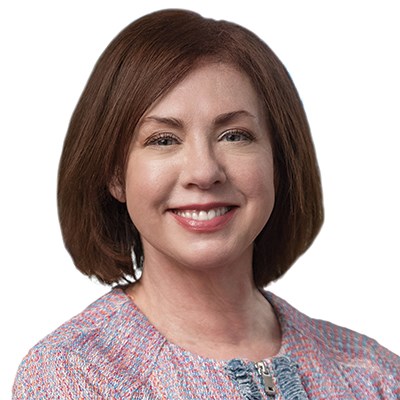

Moderator:

Chief Marketing Officer

Louis Plung & Company

Beth serves as the Chief Marketing Officer at Louis Plung & Company (LPC), a CPA firm that’s been serving clients in Pittsburgh for over 100 years. She joined the firm in October 2021 to develop marketing strategy, firm branding, strategic growth planning, staff development and pipeline management.

Panelists:

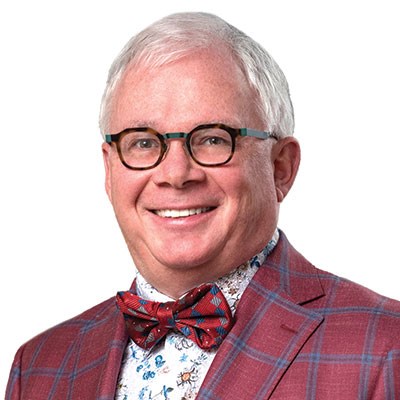

Partner

Louis Plung & Company

Thomas Bakaitus, Jr. is a CPA, MST and is a partner with Louis Plung & Company. Tom has over 30 years of Tax and M&A experience, where he uses his expertise for tax-based transactional planning & analysis. His contributions in the financial due diligence process are on both the sell-side & buy-side. In the acquisition process, Tom also plays a key role in entity structuring.

Senior Managing Director

LitCon Group

Mr. DuCarme has more than thirty years of experience involving consulting on damages assessments, forensic accounting, financial analysis and investigatory work. Mr. DuCarme has provided expert testimony in federal court, state court, and arbitration matters. He was a guest lecturer in the area of forensic accounting, damages, and business investigations at Grove City College.

Mr. DuCarme’s consulting experience includes developing affirmative damage claims or rebutting claims prepared by others. He has assessed economic losses and valuation issues on numerous matters including: disputed construction projects; breached contracts, leases, warranties and representations; terminated contracts; failed products/product liability; partnership disputes; infringement of intellectual property; eminent domain proceedings; business interruption matters; environmental disputes; and fraud investigations. Amounts in disputes have been in the hundreds of millions of dollars.

Managing Director

CIBC US Middle Market Investment Banking

Mr. Larsen is a Managing Director with CIBC US Middle Market Investment Banking. Mr. Larsen is responsible for sourcing, leading, and executing merger and acquisition, and capital raising transactions for entrepreneurs, private equity firms, and corporations. Mr. Larsen primarily works with companies in the Industrial Products and Services, Specialty Vehicle, and Manufacturing and Fabrication industries.

Managing Director

CIBC Bank USA

Annie is currently a Managing Director at CIBC Bank USA focused on middle market commercial lending and banking. As a relationship manager, Annie provides senior debt and related banking services to middle market companies (directly and via private equity investments). Companies (prospects and clients) generate $20 million to $2 billion in annual revenue and require senior debt in the $10 million to $125 million range. Annie firmly believes understanding the operations, management team, and culture of a business are paramount when developing an appropriate financing package and long-term banking relationship.

Prior to this position, Annie was a corporate lender for TriState Capital Bank. She also worked for The Bank of New York Mellon Corporation, PNC Bank and was a mathematics teacher and coach at Woodward Academy in Atlanta, GA.

Annie serves on the board of The Neighborhood Academy, Foxwall EMS, and the Pittsburgh Chapter of INFORMS.